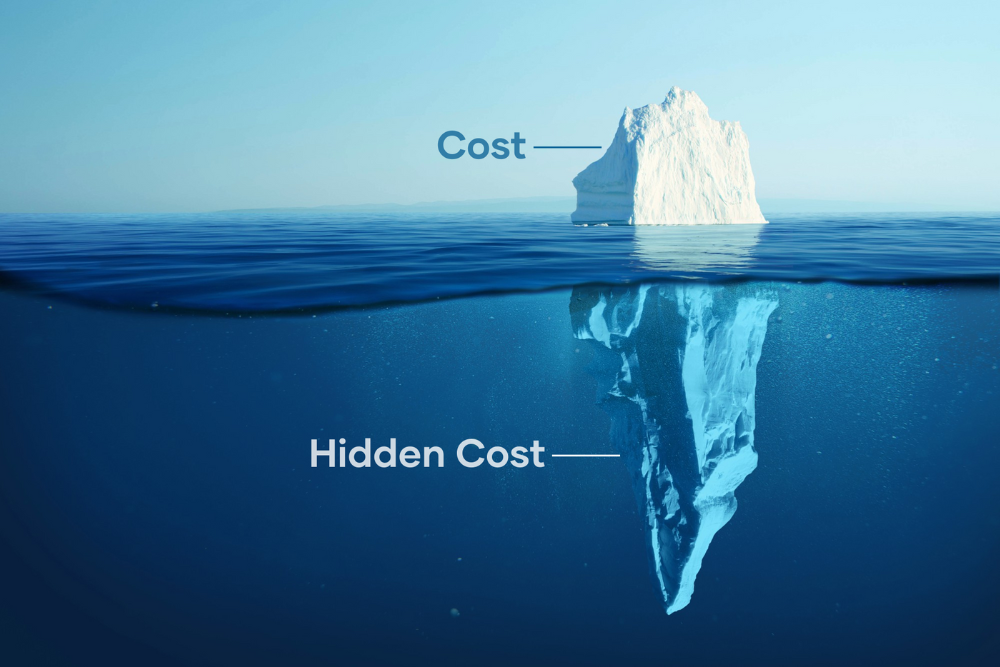

Have you been under the impression that managing leases manually saves you money? Hold on, think again! Hidden costs such as missed deadlines, late renewals, compliance issues, and lost savings quietly erode your profits. Relying on manual processes hinders your efficiency and exposes your business to significant risks.

In this blog, we’ll explore the true cost of outdated lease management and how to avoid these expensive traps.

1. Financial Inconsistencies and Errors: Manual lease tracking is prone to errors. This can lead to missed payments and incorrect escalations. A simple miscalculation in rent or other financial adjustments could cost thousands annually.

A digital lease management solution centralizes all lease-related data, automates calculations, and ensures accurate tracking of key dates and financials. This minimizes errors, reduces administrative workload, and improves financial reporting.

2. Repetitive Administrative Tasks: Managing leases manually takes a lot of time. Employees often find themselves spending hours entering data, checking lease terms, and keeping track of important dates. This inefficiency pulls focus away from strategic decision-making and essential business activities.

A lease management system streamlines data entry, monitors important dates, and provides reminders for essential deadlines. This minimizes human error and allows employees to concentrate on more valuable tasks, such as optimizing portfolios and developing cost-saving strategies.

3. Compliance and Legal Risks: Leases typically include intricate legal clauses, renewal terms, and various regulatory requirements. Depending on manual tracking can heighten the risk of missing compliance deadlines or failing to notice important clauses that might result in lawsuits or financial penalties. Failing to comply with lease obligations or tax regulations can lead to legal conflicts and harm to one’s reputation.

To address these risks, companies should implement lease management software that identifies compliance issues as they arise, making sure that important deadlines and clauses are not missed. Conducting regular reviews of lease agreements with legal professionals aids in upholding compliance and minimizing the chances of disputes. Furthermore, having a centralized digital storage system for all lease documents allows for easy access, enhances organization, and decreases the likelihood of lost or misplaced paperwork.

4. Lack of Transparency and Client Disputes: Spreadsheets and paper records fail to deliver real-time insights into portfolio performance, rental trends, or market benchmarks. Without these data-driven insights, businesses might find it challenging to make informed decisions about expansion, cost-cutting, or optimizing their properties.

Modern lease management software produces various reports, including expense reports, lease summaries, security deposit records, and analyses of lock-in periods. This gives businesses a clear, real-time overview of their lease portfolio. These insights assist in spotting cost-saving opportunities, monitoring financial obligations, and ensuring precise reporting, which helps minimize disputes with landlords and tenants. By utilizing data-driven decision-making, businesses can negotiate more favorable lease terms, predict expenses, and ensure optimal efficiency.

5. Lack of a Single Lease Repository: Managing leases through various spreadsheets, emails, and physical files can lead to confusion, resulting in misplaced documents, inconsistent data, and delays in decision-making. Without a centralized system, companies find it challenging to keep track of lease terms, payment schedules, and compliance requirements, which raises the risk of missing deadlines and incurring financial penalties. Moreover, retrieving essential lease information can be a lengthy process, hindering operations and creating inefficiencies.

The answer lies in adopting a cloud-based lease management system that brings all lease-related information into one easily accessible platform. A centralized lease repository guarantees accurate record-keeping, enhances collaboration among teams, and allows for quick access to lease documents, important dates, and financial responsibilities. This organized approach boosts efficiency, minimizes errors, and enables businesses to make informed leasing decisions.

How CRE Lease Matrix Can Help

CRE Lease Matrix makes lease management easier by automating administrative tasks, cutting down on errors, and ensuring compliance with legal and financial requirements. It keeps track of important dates, highlights potential compliance issues, and produces real-time reports, removing the inefficiencies associated with manual tracking. Consolidating lease data into one secure platform it boosts transparency and enhances decision-making, helping to avoid costly mistakes.

In addition to improving operational efficiency, CRE Lease Matrix helps lower costs by reducing financial leaks, preventing missed deadlines, and optimizing lease negotiations. Businesses can save on penalties, overpayments, and unnecessary costs while gaining valuable insights into their portfolio performance. By simplifying lease administration, CRE Lease Matrix allows companies to concentrate on growth and maximize their profitability.

Don’t let manual lease administration drain your resources. Invest in a reliable lease management solution to optimize your operations and enhance financial efficiency. Book a demo now!